- You are here:

- Home »

- Guides »

- Filling out the FAFSA: The Ultimate Guide

Filling out the FAFSA: The Ultimate Guide

Paying for college is a responsibility that many sources share, including family, the college or university, our federal government, and private sources. And given the rising cost of tuition and fees, many prospective students find themselves in a position where they cannot easily pay for school. That’s where the FAFSA and other financial aid forms come in.

What is the FAFSA? The FAFSA is the Free Application for Federal Student Aid – the only application needed to be considered for all state and federal grant and loan programs. FAFSA was created to help simplify applying for government-issued financial aid. It helps determine a student’s eligibility for aid, regardless of income level. All students applying for federal assistance must complete the Free Application for Federal Student Aid (FAFSA). There is no charge to apply for federal student financial assistance.

Financial Aid 101 Podcast Featuring Elaine Griffin of Edvisors

Get the most important tips and facts about applying for college financial aid with this episode of the YesCollege Podcast. Joining Scott to help cover this important topic is Elaine Griffin, Senior Contributor and Communications Specialist at Edvisors. Click here to view this episode’s show notes.

What You’ll Learn in This Episode:

- The most important facts to understand about student financial aid.

- What the FAFSA is, and how it works.

- How students (and even families) can get the most help and responsiveness from their colleges financial aid office.

Federal Student Aid is part of the U.S. Department of Education—the largest provider of student financial aid in the nation. Federal student aid programs are composed of grants, loans, and work-study funds. Many schools also use the FAFSA to award their own financial aid. And many states also use the FAFSA to determine eligibility for state aid. Even if you don’t think you’re eligible for aid, you should still fill out the FAFSA, because at the very least, you can qualify for a federally insured low-cost loan.

Let’s face it. College is not cheap and tuition continues to rise at private and public colleges and universities across the country: “To attend an in-state public college for the 2012-13 academic year, the average overall cost (or “sticker price”) for students who don’t receive any financial aid rose 3.8% to a record $22,261,” according to a College Board report:

So if you need financial assistance to attend college, you’ll need to know the ins and outs of the FAFSA process. The numbers don’t lie and as the economic crunch bites harder, financial aid can be a crucial component of achieving your goal of an advanced education. Keep reading to ensure you’re fully knowledgeable and ready to tackle the FAFSA with confidence.

Types of Financial Aid

If you’re applying for financial aid, there’s a good chance you’ve heard the terms “need-based” and “merit-based.” Financial aid awards are determined by these two factors: financial need and merit. Need-based awards are given to students who meet certain income requirements. Need-based awards are not automatically renewable each year. Students must renew their FAFSA application each year they plan to attend college. Merit-based awards are given to students who demonstrate superior levels of academic performance, often in combination with other attributes such as extracurricular actives and community involvement.

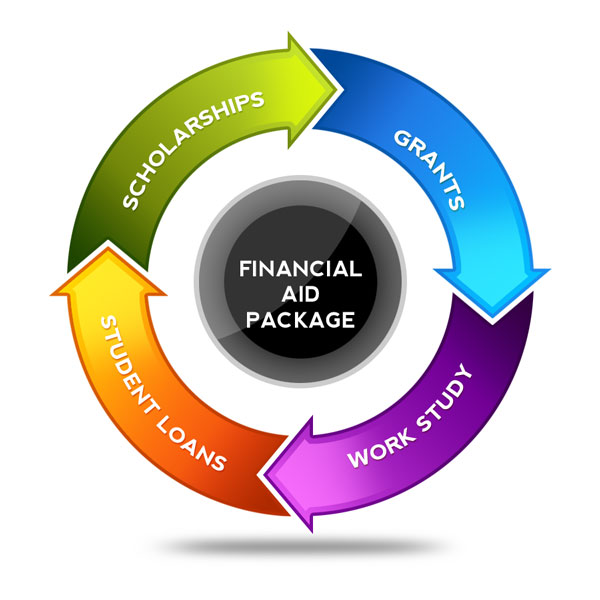

There are basically four different types of financial aid: loans, Federal Work-Study, gift aid (scholarships and grants), and miscellaneous sources:

The FAFSA can often cause my students and their parents an enormous about of stress. The paperwork involved and the time it takes to complete the application are both time consuming and resource intensive. But it’s important to understand how significant the FAFSA is, especially for students who really need financial assistance to attend college. And the smaller the budget, the more important the FAFSA is; among other things, it’s the basis for federal Pell grants! Federal Pell grants are awarded to undergraduate students based on need, and the amount of money a student can receive is directly related to the student’s financial status.

Do you need financial aid in order to go to college? Check out the diagram below to help determine if aid is needed and what options to pursue:

Step #1: Getting a PIN Number

You’ll need a Federal Student Aid PIN. It’s a unique four-digit number that can be used each year to apply for aid. It also allows you to sign your FAFSA electronically and provides access to information online. (You may also choose the option to print, sign, and mail a signature page.)

When you’re ready to fill out your FAFSA, you’ll come to this page to set up your PIN:

Source: www.fafsa.ed.gov

What do you need to get a PIN? Use the checklist below to gather the necessary information:

The security of your PIN is important because it can be used to:

- Electronically sign Federal Student Aid documents

- Access your personal records, and

- Make binding legal obligations.

If your PIN is lost or stolen, you must:

- Contact Federal Student Aid´s Customer Service center at 1-800-4-FED-AID (1-800-433-3243)

- Request a new PIN by selecting Change My PIN from the PIN Web site, or

- Disable your PIN so that no one can use it by selecting Disable My PIN from the PIN Web site.

Step #2: Gather Your Papers

Applying for financial aid can require a lot of paperwork. It takes time and careful preparation to gather all the necessary documents. According to Federal Student Aid website, you will likely need the following information or documents as you fill out the FAFSA:

- Your Social Security number

- Your parents’ Social Security numbers if you are a dependent student

- Your driver’s license number if you have one

- Your Alien Registration Number if you are not a U.S. citizen

- Federal tax information or tax returns including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are a dependent student:

- IRS 1040, 1040A, 1040EZ

- Foreign tax return and/or

- Tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federal States of Micronesia, or Palau

- Records of your untaxed income, such as child support received, interest income, and veterans noneducation benefits, for you, and for your parents if you are a dependent student

- Information on cash; savings and checking account balances; investments, including stocks and bonds and real estate but not including the home in which you live; and business and farm assets for you, and for your parents if you are a dependent student

Step #3: List Colleges and Universities

The FAFSA will require you to list at least one school to receive your information. Your financial information will be forwarded to the schools you list on the FAFSA, and the schools you list will use your FAFSA information to determine the types and amounts of aid you may receive. You can add more schools to your list at a later time. This is good opportunity to really consider what schools you want to apply to. Take this opportunity to rethink what colleges you want to attend and those schools will prepare you for your future.

TIP: You might want to consider listing your schools in alphabetical order, rather than in rank order. Admissions officers can see the list and might assume the first school is your first choice. Just to play it safe, alphabetical order will prevent the “Oh, so and so is ranking this college first. Maybe we should provide aid to another student who listed XYZ school as their top pick. Make sense? This may be a nonissue, but just to play it safe, alpha order is highly recommended.

This step is a great opportunity to think about the cost of the schools you are shooting for and what financial assistant you might receive. According to the chart below, a “strong segment of families and students are ruling out schools on the basis of cost. Yet a majority of those are considering the sticker price only and not taking into account what they might receive in financial aid.”

If your parents plan to help with tuition, the table below provides a rough estimate of expected family contribution (EFC) that corresponds with their income (AGI). This table provides an excellent visual tool to help determine if a student qualifies for need-based financial aid. Note: Parents and other stakeholders, we recommend you read the article that accompanies this graph. It’s informative and hugely helpful:

TIP: You might want to consider listing your schools in alphabetical order, rather than in rank order. Admissions officers can see the list and might assume the first school is your first choice. Just to play it safe, alphabetical order will prevent the “Oh, so and so is ranking this college first. Maybe we should provide aid to another student who listed XYZ school as their top pick. Make sense? This may be a nonissue, but just to play it safe, alpha order is highly recommended.

Step #4: Determine Your Dependency Status

What does it mean to be a dependent? A dependent is an individual (other than the taxpayer himself or his spouse) for whom the taxpayer can claim a dependency exemption. FAFSA requires students to be classified as either dependent or independent to determine your financial aid package.

Not sure of your dependency status? If you answer YES to one of the following, then you are considered independent:

- Were you born before January 1, 1990? (Applicable to the 2013-2014 school year)

- As of today, are you married? (Also answer “Yes” if you are separated but not divorced.)

- At the beginning of the 2013–2014 school year, will you be working on a master’s or doctorate program (such as an MA, MBA, MD, JD, PhD, EdD, graduate certificate, etc.)?

- Are you currently serving on active duty in the U.S. Armed Forces for purposes other than training?

- Are you a veteran of the U.S. Armed Forces?

- Do you have children who will receive more than half of their support from you between July 1, 2013 and June 30, 2014?

- Do you have dependents (other than your children or spouse) who live with you and who receive more than half of their support from you, now and through June 30, 2014?

- At any time since you turned age 13, were both your parents deceased, were you in foster care or were you a dependent or ward of the court?

- Are you or were you an emancipated minor as determined by a court in your state of legal residence?

- Are you or were you in legal guardianship as determined by a court in your state of legal residence?

- At any time on or after July 1, 2012, did your high school or school district homeless liaison determine that you were an unaccompanied youth who was homeless?

- At any time on or after July 1, 2012, did the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless?

- At any time on or after July 1, 2012, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless?

Sometimes it helps to have a visual of this information. Check out this helpful resource from the U.S. Department of Education:

Step #5: Verify Your Information

Before you submit your application, go back and double check your entries on each page. Just one misplaced number or date can cause serious delays in processing your financial aid application. Make sure you followed the process step-by-step to avoid any errors.

Examples of common errors are listed below:

- Social security numbers

- Income earned by parents/spouse

- Income tax paid

- Household size

- E-mail address

- Signatures

NOTE: Your application cannot be processed until all information is accurate and complete. We can’t stress enough the importance of reviewing your application carefully before clicking submit.

Step #6: Await Notification

Once you’ve submitted your application, the waiting game begins. You will receive notification via email (if you submitted your application electronically) or a letter in the mail verifying receipt of your application. You can check your status online by logging in to your FAFSA account. If you have been awarded a loan, contact the financial aid office at your college or university to check on the status of aid being disbursed to you or your account.

Tips for FAFSA Completion

- Don’t waste time. Start your application as soon as possible. Set aside time each day to work on your application until it’s ready for submission. You don’t want to miss deadlines!

- Ask for help. The government offers an online chat service to help students with the application process. You can also call their customer service number for help over the phone.

- Verify all information. Again, we can’t stress enough how incredibly important it is to check all information before submitting your application. Processing delays can jeopardize your financial aid package.

- Do not include assets from retirement and 401k plans. By providing this information, you can hurt your chances for aid.

- Check marital status information. If your parents are divorced, make sure only one parent claims the child – typically, the one who has lived with the student for the majority of the year.

Further Reading

Check out the sites below to learn about financial aid, completing a FAFSA, and how to approach the funding process: